Evolution of tax planning, tax day first occurred, when was the first tax day, history of making tax digital, the history of tax, history of tax day, tax day united states, when does tax day start, the evolution of taloula, the evolution of technology, the evolution of money,

Taxes are an integral part of every country's economy. They are considered the lifeblood that helps the government raise funds to provide necessary services such as healthcare, education, and infrastructure development. Over the years, taxes have undergone various changes, and the way they are collected and monitored has also evolved. In this post, we take a look at the evolution of taxes and how technology has impacted the way we pay taxes.

Evolution of Tax Freedom Day

.gif)

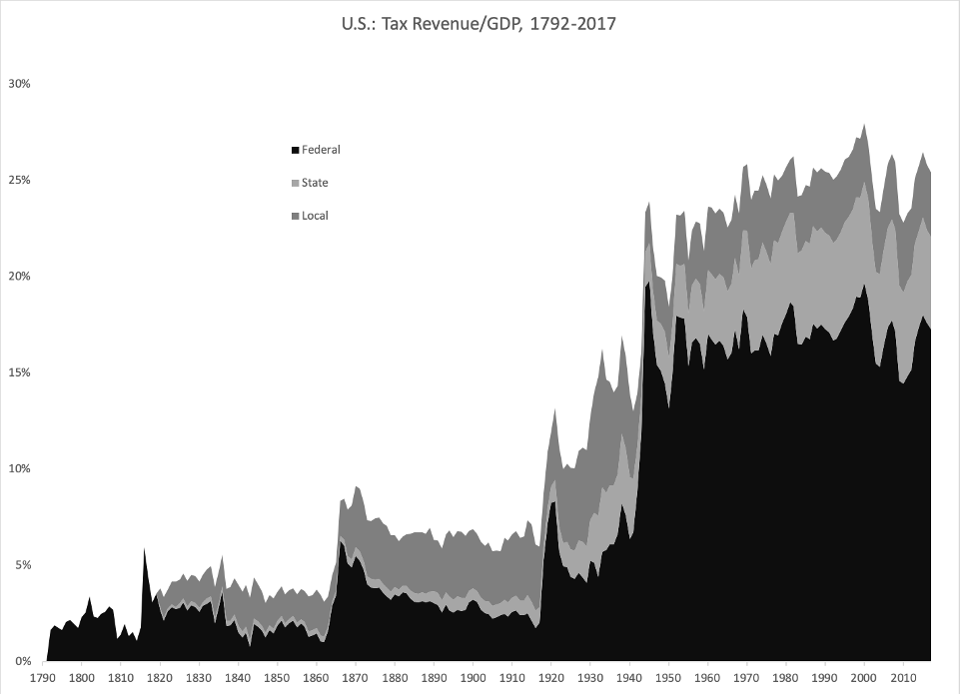

The concept of Tax Freedom Day was first introduced in the 1940s by the Tax Foundation, a non-profit organization based in Washington D.C. It is the day of the year when the average American has earned enough to pay their federal, state, and local taxes for the year. The infographic above shows the Evolution of Tax Freedom Day from 2007 to 2008. As you can see, Tax Freedom Day has been moving later in the year, which means that Americans are paying more taxes.

The Evolution Of Tax Technology

The way taxes are collected and monitored has undergone significant changes over the years. With the advancements in technology, the process of filing taxes has become more convenient and efficient. The above infographic shows the Evolution of Tax Technology, from the manual process of filling out paper forms to the current online filing system. With the introduction of e-filing, taxpayers can now file their taxes from the comfort of their homes, reducing the need for physical visits to tax offices. The use of automation tools has also made the process of tax collection and auditing more accurate and fast.

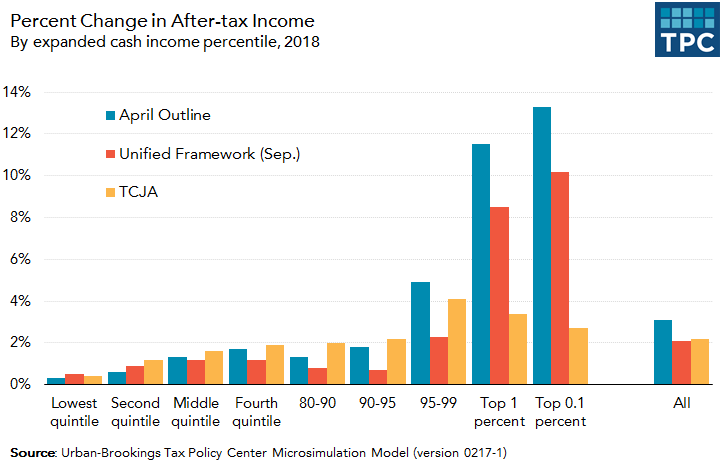

How The Tax Cuts and Jobs Act Evolved

The Tax Cuts and Jobs Act (TCJA) is a tax reform bill that was signed into law in December 2017. The above infographic shows the Evolution of the TCJA, from its introduction as a proposal to its implementation. The TCJA aimed to simplify the tax code and provide tax relief to individuals and businesses. With the introduction of new tax brackets, increased standard deductions, and tweaks to deductions and exemptions, taxpayers saw changes in their tax bills. The TCJA also impacted businesses, with reduced corporate tax rates and the introduction of new tax deductions.

Evolution of Service Tax in India

Taxes in India have also undergone significant changes over the years. The above infographic shows the Evolution of Service Tax in India, from its introduction in 1994 to its current state. Service Tax is a tax levied by the government on all services, excluding a few specified services. Over the years, the scope of Service Tax has been expanded, and the tax rate has increased, impacting both service providers and consumers. The introduction of the Goods and Services Tax (GST) in 2017 replaced Service Tax and other indirect taxes, providing a more unified tax structure for businesses and consumers.

IRS Drops Longstanding Promise Not to Compete Against TurboTax

The above image shows how technology has impacted the relationship between the Internal Revenue Service (IRS) and tax preparation software services such as TurboTax. In January 2020, the IRS dropped its longstanding promise not to compete against tax preparation software services. As a result, the IRS launched its own Free File Program, which allows eligible taxpayers to prepare and file their federal tax returns for free. This move has been both praised and criticized by taxpayers, with some welcoming the competition and others concerned about potential conflicts of interest.

In conclusion, taxes have always been an essential part of any country's economy, and their evolution has impacted individuals and businesses alike. With advancements in technology, the process of tax collection and payment has become more efficient and convenient for taxpayers. However, it is essential to keep in mind that taxes are crucial for the functioning of society and ensure that the necessary funds are available for the provision of essential services.

The Evolution of Tax Day: From Paper Forms to Online Filing

If you are looking for The evolution of tax technology new world economics, you've came to the right place. We have images like Irs drops longstanding promise not to compete against turbotax ars, evolution of tax system in india blog by quicko, día del contribuyente. Here you go:

Paper calculations 20% of americans are making this tax filing mistake, the evolution of tax a fiftyyear perspective by rsm global issuu

Evolution of service tax in india. Tax irs refund filing getty received turbotax deductions if representation taxes year contact haven deficiency notice agent estate every should. Evolution tax india system quicko 1974. Evolution tax india system quicko come ve way long. Evolution of tax system in india blog by quicko. Paper calculations 20% of americans are making this tax filing mistake. Closing the gap between formal and material health care coverage in

Also read:

.Blog Archive

-

▼

2023

(110)

-

▼

May

(68)

- The Evolution Of The Boston Marathon: From Amateur...

- Opening Day Mlb 2023 Que Es

- What Is An Indictment Number

- Understanding Tax Day: The History And Purpose Of ...

- Mlb Opening Day Dodgers

- Mlb Opening Day 2023 Rosters

- Mlb Projected Opening Day Starters

- Christmas Day Shooting Nashville Tn

- What Is Indictment Mean In Law

- Mlb Opening Day Hats

- Mlb Opening Day Betting Trends

- What Is Indictment In Law

- Mlb Opening Day 2023 First Game

- What Is Investigation Under Crpc

- What Is Indict Used In A Sentence

- What Is Jpc Investigation

- Mlb Opening Day Bets

- When Was Mlb Opening Day

- Good Friday In The Bible: Examining The Scriptural...

- Downtown Nashville Shooting Last Night

- What Is Investigation Evaluation

- Alvin Bragg Mailing Address

- What Is Investigation Examination

- Alvin Bragg Transition Team

- Mlb Opening Day Fixtures

- Cop Shooting In Nashville

- What Does Indicted Mean In Us Law

- From Presidents To Laborers: State Holidays That H...

- Opening Day Mlb 2023 Cubs

- Nashville Shooting Parking Lot

- Is An Indictment A Charge

- What Is An Indictment Hearing

- Da Alvin Bragg Jose Alba

- Opening Day Of Mlb

- Opening Day Mlb 2023 Yankees

- Mlb Opening Day 2023 Mets

- Orthodox Good Friday: Understanding The Difference...

- Celebrating Holy Saturday At Home: Ideas For Famil...

- Mlb Opening Day Video

- Emancipation Day And Education: The Importance Of ...

- Mlb Opening Day Lineups Quiz

- What Is Laboratory Investigation

- Mlb Opening Day Hashtags

- What Is Pre Indictment Hearing

- Celebrating Holy Saturday At Home: Ideas For Famil...

- Easter Monday And The Easter Season: A Time For Re...

- The Music Of Orthodox Easter: From Chanting To Bel...

- What Is Indictment Jail

- Officer Involved Shooting Nashville Today

- How Long Until Mlb Opening Day

- Celebrating Good Friday: Ideas For Honoring The Ho...

- What Happened To Stormy Daniels Attorney

- Mlb Opening Day Yankees

- What Is Investigation How Does It Differ From Audi...

- Mlb Opening Day Viewership

- The Evolution Of Tax Day: From Paper Forms To Onli...

- Theological Insights Into Holy Saturday And Its Im...

- From Pagans To Christians: The History Of Easter S...

- Good Friday And The Arts: How Artists Have Depicte...

- Lailat Al-Qadr And Forgiveness: The Spiritual Sign...

- Comparing The Boston Marathon To Other Major Marat...

- Mlb Opening Day Dfs

- The Evolution Of The Boston Marathon: From Amateur...

- Nashville Shooting Outlet Mall

- Nashville Smile Direct Club Shooting

- What Is Indictment Jail

- Mlb Opening Day 2023 Schedule

- Nashville Shooting June 2022

-

▼

May

(68)

Total Pageviews

Search This Blog

Popular Posts

-

Alamat rumah yuni shara di batu caves, alamat rumah yuni shara di batushka, alamat rumah yuni shara di batu ginjal, alamat rumah yuni shara ...

-

Exemple de compte mail, exemple de compte gmail, exemple de compte mail, exemple de compte gmail, exemple de compte rendu pdf, exemple de co...

-

Minecraft mod cars, minecraft mod cartoon, minecraft mod carpenter blocks, minecraft mod carry on, minecraft mod carpentry block, minecraft ...